Green Tariffs as Market Accelerators for Corporate Renewable Energy Adoption: A Comprehensive Review of U.S. Programs and their Impact on C&I Decarbonization

Journal of Engineering Research and Sciences, Volume 4, Issue 8, Page # 1-17, 2025; DOI: 10.55708/js0408001

Keywords: Green Tariffs, Renewable Energy Procurement, Corporate Sustainability, Utility Programs, Decarbonization, C&I Customers, Regulated Markets

(This article belongs to the Section Green and Sustainable Science & Technology (GSS))

Export Citations

Cite

Shah, S. (2025). Green Tariffs as Market Accelerators for Corporate Renewable Energy Adoption: A Comprehensive Review of U.S. Programs and their Impact on C&I Decarbonization. Journal of Engineering Research and Sciences, 4(8), 1–17. https://doi.org/10.55708/js0408001

Sahil Shah. "Green Tariffs as Market Accelerators for Corporate Renewable Energy Adoption: A Comprehensive Review of U.S. Programs and their Impact on C&I Decarbonization." Journal of Engineering Research and Sciences 4, no. 8 (August 2025): 1–17. https://doi.org/10.55708/js0408001

S. Shah, "Green Tariffs as Market Accelerators for Corporate Renewable Energy Adoption: A Comprehensive Review of U.S. Programs and their Impact on C&I Decarbonization," Journal of Engineering Research and Sciences, vol. 4, no. 8, pp. 1–17, Aug. 2025, doi: 10.55708/js0408001.

This paper provides a comprehensive review of green tariff programs in the United States from 2013 to 2025, examining their role as market accelerators for corporate renewable energy adoption and their impact on commercial and industrial (C&I) decarbonization strategies. Green tariffs represent voluntary utility programs that enable large energy customers to procure renewable electricity directly through their serving utility, offering an alternative pathway to complex bilateral power purchase agreements. Through systematic analysis of 62 active programs across 30 states, this review synthesizes literature on program design, implementation challenges, market impacts, and effectiveness in driving corporate sustainability goals. Key findings indicate that while green tariffs have facilitated over 5,700 MW of renewable capacity additions and attracted major corporate participants, significant barriers remain including limited program capacity, regulatory complexity, and questions around additionality—specifically whether programs drive new renewable development versus reallocating existing resources. The review identifies critical design elements for successful programs, including flexible contracting mechanisms, transparent pricing structures, and alignment with corporate sustainability requirements. This paper contributes to the growing body of knowledge on utility-corporate partnerships in clean energy transition and provides actionable insights for three key stakeholder groups—utilities, regulators, and corporate energy buyers—navigating the evolving renewable energy procurement landscape.

1. Introduction

The global transition to renewable energy has emerged as a critical imperative in addressing climate change, with corporate actors playing an increasingly prominent role in driving demand for clean electricity [1]. As of 2024, over 2,500 companies worldwide have committed to science-based emissions targets, creating unprecedented demand for renewable energy procurement options [2]. Within the United States, this corporate sustainability movement has encountered unique challenges in traditionally regulated electricity markets, where approximately 40% of electricity is generated but corporate renewable energy deals remained limited—accounting for only 16% between 2012 and 2017, with this share gradually increasing to approximately 25% by 2024 as market mechanisms evolved [3].

Green tariffs have emerged as an innovative solution to bridge this gap, representing voluntary utility programs that allow eligible commercial and industrial customers to purchase bundled renewable electricity from specific projects through special utility tariff rates [3]. Unlike traditional green pricing programs that often charge premium rates without providing direct access to renewable energy certificates (RECs), green tariffs offer a mechanism for large energy users to meet sustainability goals while maintaining relationships with incumbent utilities [4].

The rapid evolution of green tariff programs reflects broader transformations in energy markets and corporate sustainability strategies. From initial pilots in 2013 to over 62 active or pending programs across 30 states as of 2023, green tariffs have facilitated more than 3,000 MW of renewable energy procurement in 2022 alone, representing approximately 25% of total corporate renewable energy deals with known contract types [3,5]. This growth has been driven by convergent factors including declining renewable energy costs across multiple technologies—with utility-scale solar costs declining by over 85%, onshore wind costs falling by 70%, and battery storage costs dropping by 90% between 2010 and 2020—making renewable energy increasingly cost-competitive with traditional generation sources [6].

Despite this momentum, significant questions remain regarding the effectiveness of green tariffs in accelerating renewable energy deployment and achieving genuine additionality beyond business-as-usual scenarios [7]. Critics argue that some programs merely reallocate existing renewable resources without driving new capacity additions, while proponents highlight successful partnerships between utilities and corporations that have enabled significant renewable energy investments [8,9].

Research Objective: This comprehensive review aims to systematically evaluate the effectiveness of green tariff programs as market accelerators for corporate renewable energy adoption in U.S. regulated electricity markets, with specific focus on: (1) identifying design features that maximize program success and renewable energy deployment, (2) assessing the extent to which programs achieve genuine additionality versus resource reallocation, and (3) providing evidence-based recommendations for optimizing program design to accelerate the clean energy transition across diverse stakeholder groups.

2. Literature Review

2.1. Evolution of Corporate Renewable Energy Procurement

The corporate renewable energy procurement landscape has undergone significant transformation over the past decade, driven by converging economic, environmental, and social factors [10]. Early corporate sustainability efforts primarily relied on unbundled renewable energy certificates (RECs), which provided a simple mechanism for companies to claim renewable energy use but faced criticism for limited additionality and minimal impact on renewable energy deployment [11,12].

As corporate sustainability commitments matured, companies increasingly sought more impactful procurement strategies that could demonstrate clear connections to renewable energy projects and provide economic benefits through long-term price stability [13]. This evolution coincided with dramatic cost reductions across renewable energy technologies. Beyond the well-documented 85% decline in utility-scale solar costs, onshore wind levelized costs decreased by approximately 70%, offshore wind by 50%, and battery storage systems by 90% between 2010 and 2020. These cost reductions, driven by technological improvements, manufacturing scale, and learning curve effects, fundamentally altered the economics of renewable energy procurement [14].

The emergence of power purchase agreements (PPAs) represented a significant advancement in corporate procurement options, enabling direct contracts between corporations and renewable energy developers [15]. However, PPAs present substantial complexity, requiring sophisticated energy management capabilities, creditworthiness, and willingness to assume market risks that many companies find challenging [16,17]. Furthermore, in traditionally regulated electricity markets, regulatory barriers often prevent direct corporate-developer transactions, limiting PPA availability to competitive wholesale markets [18].

2.2. Theoretical Framework for Green Tariffs

Green tariffs emerged within this context as a hybrid mechanism that combines elements of utility procurement with corporate renewable energy demand [19]. The theoretical foundation for green tariffs rests on several economic and policy principles. First, they address market failures in regulated electricity markets where monopoly utilities control electricity supply and direct access to renewable generators is restricted [20]. By creating a regulated pathway for renewable energy procurement, green tariffs can unlock latent demand while maintaining utility system integrity [21].

Second, green tariffs leverage utilities’ unique capabilities in project development, grid integration, and risk management to reduce transaction costs for corporate buyers [22]. Utilities’ expertise in power procurement, established creditworthiness, and regulatory relationships can facilitate more efficient renewable energy deployment than individual corporate efforts [23]. This efficiency gain becomes particularly relevant for medium-sized companies that lack resources for complex bilateral negotiations [24].

Third, from a regulatory economics perspective, green tariffs represent a form of product differentiation in monopoly markets, allowing utilities to offer varying service levels based on customer preferences while maintaining cost allocation principles that protect non-participating ratepayers [25]. This differentiation can enhance overall welfare by better matching heterogeneous customer preferences with appropriate service offerings [26].

2.3. Additionality: Definition and Significance

A critical concept in evaluating green tariff effectiveness is “additionality”—defined as the extent to which a renewable energy procurement mechanism drives new renewable energy capacity that would not have been developed otherwise [7]. Additionality ensures that corporate renewable energy purchases result in genuine incremental environmental benefits rather than merely shifting ownership of existing renewable resources. For green tariffs, additionality can be assessed across three dimensions:

- Project Additionality: Whether the program requires new renewable projects (typically defined as reaching commercial operation within 3 years of contract signing)

- System Additionality: Whether renewable resources procured exceed utility renewable portfolio standard (RPS) requirements

- Economic Additionality: Whether corporate participation provides necessary revenue certainty for project financing

The significance of additionality in green tariff design cannot be overstated, as programs lacking strong additionality requirements may enable “greenwashing” without contributing to decarbonization goals [27].

2.4. Green Tariff Design and Implementation

The literature identifies several critical design elements that influence green tariff program effectiveness. Program structure varies significantly across jurisdictions, with three primary models emerging: subscriber programs, sleeved PPAs, and market-based rate structures [28,29].

Subscriber programs aggregate demand from multiple customers to support utility-procured renewable projects, offering simplified participation but potentially limiting customer choice in project selection [30]. Notable examples include Puget Sound Energy’s Green Direct program, which successfully attracted major customers including Target, Starbucks, and REI through competitive pricing and flexible contract terms [31].

Sleeved PPAs represent a more customized approach where utilities facilitate bilateral contracts between customers and renewable developers, essentially passing through contract terms while managing grid integration and administrative functions [32]. Duke Energy’s Green Source Advantage program exemplifies this model, enabling customers like Google and Walmart to contract directly with solar developers while maintaining utility relationships [33].

Market-based rate structures allow customers to pay wholesale market prices plus renewable energy premiums, providing transparency but exposing participants to market volatility [34]. Dominion Energy’s renewable energy supply service pioneered this approach, though uptake has been limited due to complexity and risk exposure [35].

2.5. Barriers and Challenges

Despite growing interest, green tariff implementation faces numerous barriers documented across academic and industry literature. Regulatory complexity represents a primary challenge, as programs require approval from state public utility commissions that must balance multiple stakeholder interests [36]. The regulatory approval process often extends multiple years, creating uncertainty for both utilities and potential customers [37].

Capacity constraints emerge as another significant limitation, with many programs quickly reaching subscription limits due to conservative initial sizing [38]. For instance, Xcel Energy’s Renewable*Connect program in Minnesota reached full subscription within months of launch, necessitating program expansion proposals [39]. These constraints reflect utilities’ caution in committing to long-term renewable contracts without assured customer demand [40].

The literature reveals contradictory evidence on additionality: while [41] found that 30% of programs allow existing resources, potentially limiting additionality, Heeter and Bird [42] demonstrate that even these programs can drive incremental development by freeing renewable portfolio standard (RPS) capacity for system-wide needs. The interaction between green tariffs and state renewable portfolio standards creates particular complexity, as some programs may simply redirect RPS-eligible generation to green tariff customers without increasing total renewable deployment [42].

Pricing and cost allocation present additional challenges, as utilities must design rates that attract corporate customers while avoiding cost shifts to non-participants [43]. This balance becomes particularly difficult when renewable energy costs exceed system average costs, requiring careful rate design to maintain competitiveness [44]. Furthermore, administrative costs for program management, billing systems, and regulatory compliance can create overhead that diminishes program attractiveness [45].

2.6. Market Impacts and Effectiveness

Empirical evidence on green tariff effectiveness remains mixed, reflecting program diversity and measurement challenges. Quantitative analyses indicate that green tariffs have facilitated substantial renewable capacity additions, with the Clean Energy Buyers Association tracking over 5,700 MW of cumulative procurement through 2023 [5]. However, attribution remains complex, as some projects might have proceeded through alternative procurement mechanisms [46].

Economic impacts extend beyond direct renewable energy deployment. Green tariffs can enhance utility revenue stability through long-term customer commitments, potentially improving utility credit profiles and reducing capital costs [47]. For participating corporations, programs provide budget certainty through fixed pricing structures while supporting sustainability reporting requirements [48]. These findings align with earlier work by [19] and [30], who identified revenue stability as a key driver for utility adoption of green tariff programs.

Regional economic benefits include job creation in renewable energy construction and operations, with multiplier effects in rural communities hosting projects [49]. Duke Energy reported that its Green Source Advantage program supported over 1,000 construction jobs and $500 million in economic investment across North Carolina [50], corroborating theoretical predictions by [20] regarding the local economic benefits of renewable energy deployment.

Market transformation effects appear significant, as green tariffs normalize corporate-utility collaboration and demonstrate viable pathways for renewable integration in regulated markets [51]. This demonstration effect has encouraged regulatory innovation, with states increasingly viewing green tariffs as tools for economic development and clean energy leadership [52].

2.7. Research Gap

Despite growing implementation of green tariff programs, the literature reveals a significant gap in synthesized insights regarding how these programs contribute to actual renewable energy deployment in regulated markets. While individual program evaluations exist, comprehensive analysis linking program design features to deployment outcomes remains limited. This review addresses this gap by systematically examining the relationship between green tariff design elements and their effectiveness in driving genuine renewable energy capacity additions beyond business-as-usual scenarios.

2.8. Summary of Key Literature

Table 1: Summary of Key Green Tariff Studies

Study | Focus Area | Key Findings | Limitations |

[4] | Program Inventory | First comprehensive catalog of U.S. Programs | Limited outcome data |

[19] | Design principles | Identified flexibility as key success factor | Theoretical focus |

[30] | Market analysis | Documented early adoption patterns | Pre-2018 data |

[41] | Additionality | 70% programs require new resources | Self-reported data |

[5] | Market tracking | 5,700 MW total procurement | Attribution unclear |

The literature reveals clear connections between theoretical frameworks and practical design choices. Transaction cost economics explains why utilities can offer lower-cost renewable procurement than individual corporate efforts, while regulatory economics illuminates the need for careful rate design to avoid cross-subsidization. These theoretical insights directly inform the program design variations observed in practice.

3. Methodology

3.1. Systematic Review Process

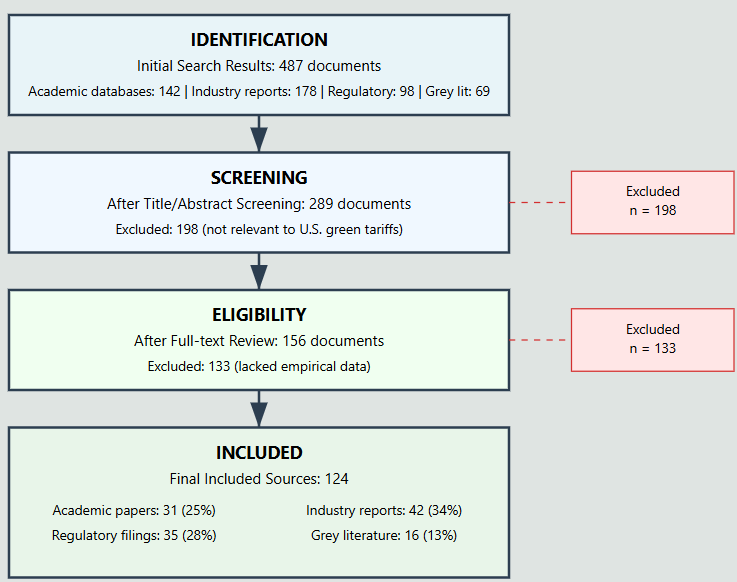

This comprehensive review employs a systematic literature review methodology following PRISMA guidelines to analyze green tariff programs and their impacts on corporate renewable energy adoption. The step involved in review process is shown in figure 1.

3.2. Data Collection

Literature identification utilized multiple academic databases including Web of Science, Scopus, Google Scholar, and specialized energy databases. Search terms included combinations of “green tariff,” “utility renewable programs,” “corporate renewable energy procurement,” “regulated market renewable energy,” and “C&I sustainability programs.” Additionally, targeted searches of regulatory databases, utility websites, and industry association publications provided primary source documentation.

Inclusion criteria encompassed: (1) English-language publications addressing U.S. green tariff programs, (2) documents containing empirical data or case studies of program implementation, (3) regulatory filings and utility program proposals, and (4) industry reports from recognized authorities. Exclusion criteria eliminated international programs, residential-focused initiatives, and purely promotional materials lacking substantive analysis.

3.3. Analytical Framework

The analysis employs a mixed-methods approach combining quantitative program metrics with qualitative assessment of design features and stakeholder perspectives. Quantitative analysis examines program capacity, subscription rates, pricing structures, and renewable energy deployment outcomes.

Qualitative analysis utilized thematic coding to identify recurring design elements, implementation challenges, and success factors across programs. The coding process involved:

- Initial coding: Identifying design features, barriers, and outcomes

- Axial coding: Establishing relationships between categories

- Selective coding: Developing overarching themes linking design to effectiveness

Comparative analysis was employed to assess how different program design features correlate with deployment outcomes, participation rates, and stakeholder satisfaction. This approach enabled identification of best practices and common pitfalls across diverse regulatory environments.

The review framework incorporates multiple theoretical lenses including transaction cost economics, regulatory economics, and innovation diffusion theory to interpret findings. This multidisciplinary approach enables comprehensive understanding of green tariffs as both regulatory instruments and market mechanisms.

3.4. Data Limitations

Several limitations affect the data sources used in this review. Utility self-reporting may introduce positive bias in program outcomes, as utilities have incentives to highlight successes. Regulatory filings, while official, may not capture implementation challenges or customer dissatisfaction. Grey literature from industry associations may reflect member interests. To address these limitations, the analysis triangulates findings across multiple source types and explicitly notes where evidence conflicts.

4. Results and Analysis

4.1. Current Landscape of Green Tariff Programs

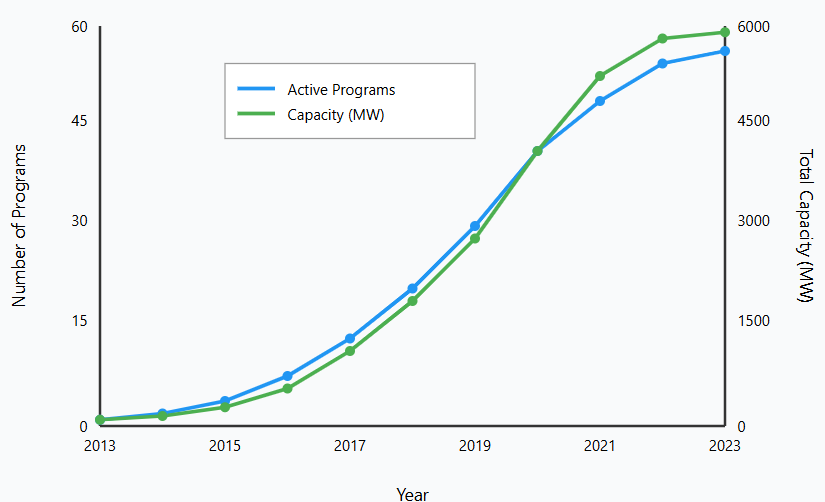

As of 2023, the Clean Energy Buyers Association identifies 50 approved green tariff programs across 40 utilities, with an additional 12 programs pending regulatory approval [5]. The evolution of these programs demonstrates remarkable growth from just 2 programs in 2013 to the current landscape, with cumulative capacity increasing from 50 MW to over 5,700 MW (Figure 2). This growth trajectory reflects both increasing corporate demand and utility recognition of green tariffs as strategic offerings [53].

4.2. Regional Distribution and Program Characteristics

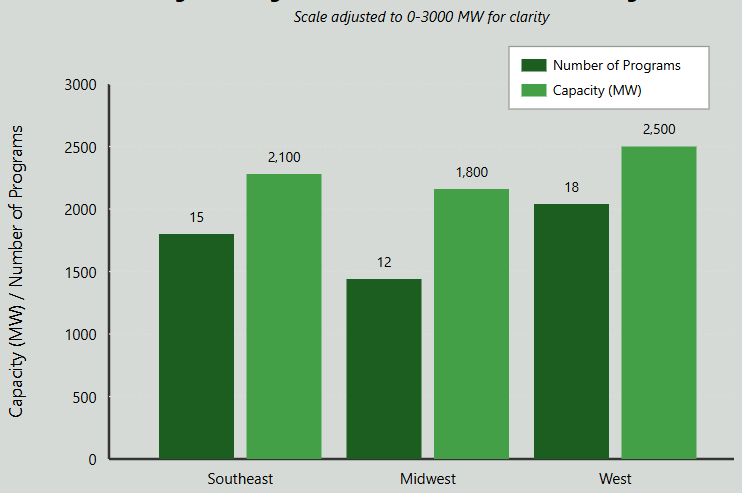

Geographic distribution shows concentration in states with strong renewable resources and progressive energy policies, though programs increasingly appear in traditionally coal-dependent regions seeking economic diversification [53]. Regional analysis reveals the West leads with 18 programs, followed by the Southeast with 15 programs, demonstrating broad national adoption (Figure 3).

Program characteristics vary significantly across jurisdictions, reflecting local regulatory frameworks, renewable resource availability, and customer demand profiles. Minimum participation thresholds range from 100 kW to 10 MW, effectively limiting access to large commercial and industrial customers [54]. Contract terms typically span 10-20 years, aligning with renewable project financing requirements while providing long-term price stability for participants [55].

Table 2: Green Tariff Program Distribution by Region

Region | Number of Programs | Total Capacity (MW) | Major Participants |

Southeast | 15 | 2,100 | Duke, Dominion, Georgia Power |

Midwest | 12 | 1,800 | Xcel, DTE, AEP |

West | 18 | 2,500 | PG&E, PSE, NV Energy |

Southwest | 5 | 1,300 | APS, SRP, PNM |

4.3. Program Design Analysis

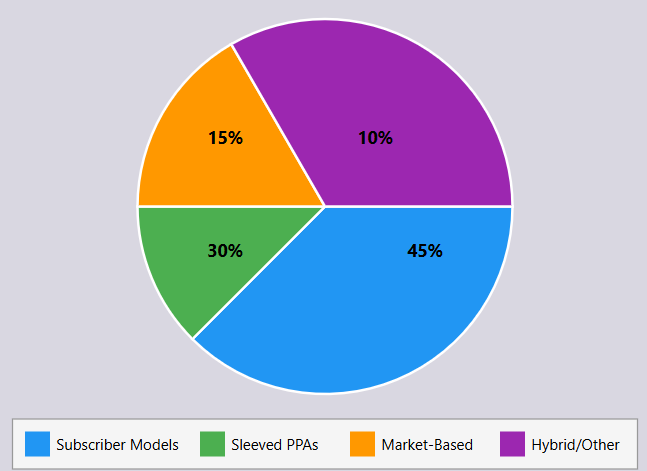

Comprehensive analysis of existing programs reveals several design categories with distinct characteristics and outcomes. Figure 4 illustrates the distribution of program types, with subscriber models dominating at 45% of approved programs, followed by sleeved PPAs at 30%, market-based structures at 15%, and hybrid models at 10% [56]. Each model offers distinct trade-offs between customer flexibility, risk allocation, and implementation complexity.

Table 3: Comparison of Green Tariff Program Models

Model Type | Customer Choice | Risk Allocation | Complexity | Typical Capacity Range |

Subscriber | Limited | Utility bears most | Low | 200kW- 5MW |

Sleeved PPA | High | Shared | Medium | 1MW – 50MW |

Market-based | Medium | Customer bears most | High | 5MW+ |

4.3.1. Subscriber Models

Subscriber programs represent the most common structure, accounting for approximately 45% of approved programs [56]. These programs aggregate customer demand to support utility-procured renewable projects, offering standardized terms and simplified administration. Successful examples include:

- Xcel Energy’s Renewable*Connect (Colorado): Offers flexible subscription blocks starting at 200 kW, with pricing at approximately $0.02/kWh premium over standard rates [57]. The program achieved full subscription of 50 MW within six months, prompting expansion proposals [39].

- Puget Sound Energy’s Green Direct: Provides 100% renewable energy from dedicated wind and solar resources at competitive rates, attracting major customers including Microsoft, Starbucks, and Target [58]. The program’s success stems from transparent pricing, long-term contracts, and local economic benefits [31].

4.3.2. Sleeved PPA Structures

Sleeved PPA programs enable greater customer choice in project selection while maintaining utility administration, representing approximately 30% of programs [59]. These structures appeal to sophisticated buyers seeking specific project attributes:

- Duke Energy’s Green Source Advantage: Facilitates direct negotiations between customers and developers, with Duke managing interconnection and contract administration [60]. The program has enabled over 1,000 MW of solar development, demonstrating scalability of the sleeved model [33].

- Dominion Energy’s Renewable Energy Supply: Allows customers to identify specific projects meeting their requirements, with Dominion providing transmission and balancing services [61]. Despite flexibility, complex negotiations have limited participation to large, sophisticated buyers [35].

4.3.3. Market-Based Rates

Market-based programs expose customers to wholesale market prices plus renewable premiums, representing approximately 15% of programs [62]. While offering transparency, market volatility has limited adoption:

- AEP’s Renewable Energy Purchase Tariff: Links customer rates to PJM wholesale prices plus renewable energy costs, providing direct market exposure [63]. Limited uptake reflects customer preference for price certainty over market optimization [64].

4.3.4. Hybrid and Innovative Models

Emerging programs combine elements from multiple models or introduce novel features:

- NV Energy’s Green Energy Rate: Incorporates time-of-use pricing with renewable energy procurement, encouraging load shifting to maximize renewable utilization [65]. This innovation addresses grid integration challenges while providing customer value [66].

- Portland General Electric’s Green Future Impact: Combines subscriber model with community benefits, dedicating portion of revenues to low-income renewable programs [67]. This approach addresses equity concerns while maintaining program viability [68].

4.4. Pricing Structures and Economics

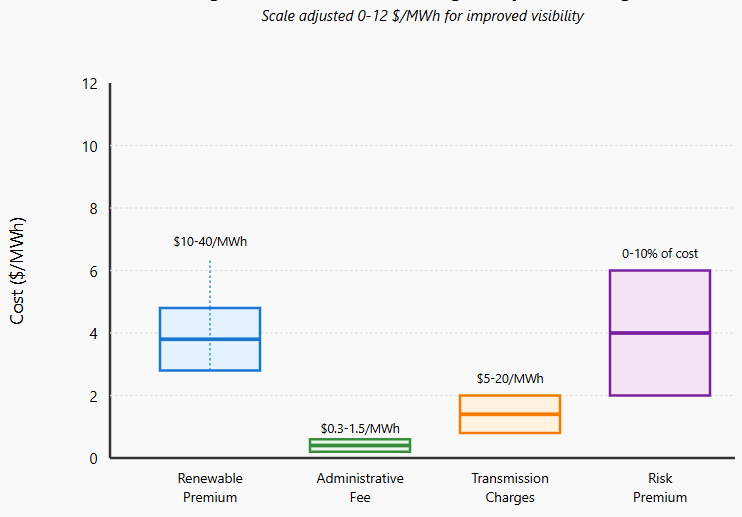

Green tariff pricing encompasses multiple components that significantly influence program attractiveness and viability [69]. Analysis of 30 programs with publicly available pricing data reveals common structures and ranges:

Table 4: Green Tariff Pricing Component

Component | Typical Range | Purpose | Impact on Adoption |

Renewable Premium | $0.01-0.04/kWh | Cover above-market renewable costs | Primary adoption barrier |

Administrative Fee | $100-500/month | Program management costs | Minor impact |

Transmission Charges | $0.005-0.02/kWh | Grid integration costs | Varies by location |

Risk Premium | 0-10% of Project cost | Credit, development risks | Significant for small customers |

Economic analysis indicates that green tariff participants typically experience 5-15% higher electricity costs compared to standard service, though long-term contracts provide hedge value against future price volatility [70]. Return on investment calculations must incorporate multiple factors including REC ownership value, sustainability reporting benefits, and potential carbon pricing exposure [71].

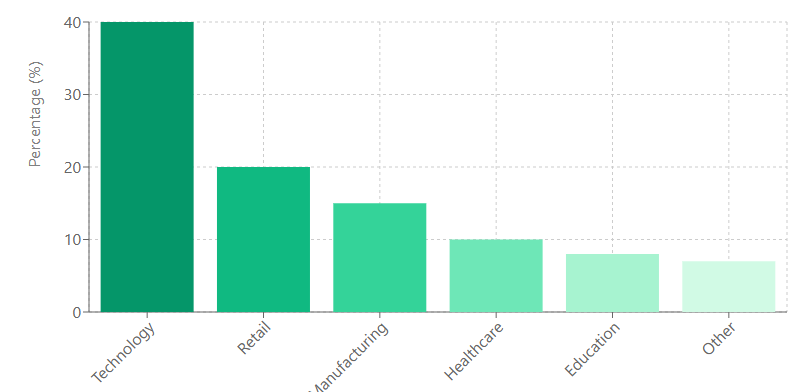

4.5. Corporate Participation Patterns

Analysis of participation data reveals distinct patterns in corporate adoption of green tariff programs. Technology companies represent the largest participant category, accounting for approximately 40% of subscribed capacity [72]. This concentration reflects both sustainability commitments and 24/7 operational profiles that align with renewable generation patterns [73].

Geographic factors significantly influence participation, with companies prioritizing facilities in states offering green tariff programs for renewable energy procurement [74].

This “green tariff effect” on facility siting decisions demonstrates programs’ economic development potential [75].

Company size analysis reveals bimodal distribution, with large multinationals (>$10B revenue) accounting for 45% of participation and regional leaders ($100M-1B) representing 20% of the market. Mid-size companies often lack resources for complex negotiations while smaller firms fall below minimum thresholds [76].

4.5.1. Equity and Participation Barriers

Participation analysis reveals significant barriers for small and mid-sized companies:

Minimum Load Thresholds: Programs typically require 100 kW to 10 MW minimum participation, excluding approximately 95% of commercial customers. These thresholds reflect utilities’ administrative cost recovery needs but create systematic exclusion.

Transaction Complexity: Even “simplified” subscriber programs require:

- Legal review of 20-50 page contracts

- Financial analysis of 10-20 year commitments

- Internal approval processes taking 3-12 months

- Estimated transaction costs of $50,000-200,000

These barriers effectively limit participation to companies with dedicated sustainability staff and significant legal/financial resources, perpetuating inequitable access to renewable energy benefits.

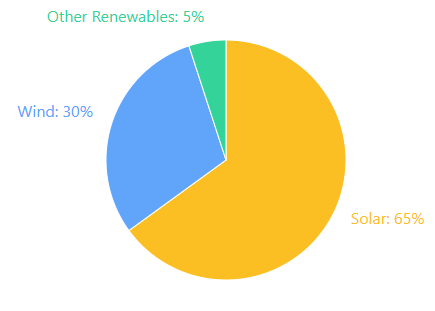

4.6. Renewable Energy Deployment Outcomes

Quantifying green tariff impacts on renewable energy deployment requires careful analysis to establish additionality. The claim that green tariffs accelerate renewable deployment by 2-3 years is based on comparative analysis of:

- Contracted Capacity: Over 5,700 MW renewable capacity contracted through green tariffs as of 2023 [5].

- Operational Projects: Approximately 3,500 MW operational, with remaining capacity under development [77].

- Technology Mix: 65% solar, 30% wind, 5% other renewable sources (Figure 7) [78].

- Geographic Distribution: Projects concentrated in high-resource areas but increasingly spreading to load centers [79].

4.6.1. Additionality Assessment

The claim that green tariffs accelerate renewable deployment by 2-3 years is based on comparative analysis of:

- Baseline Scenario: Utility integrated resource plans (IRPs) filed before green tariff implementation showing planned renewable additions

- Actual Deployment: Renewable projects developed under green tariff programs

- Acceleration Calculation: Difference between IRP-projected dates and actual commercial operation dates

For example, Duke Energy’s 2018 IRP projected 1,200 MW of solar additions by 2028. However, Green Source Advantage program contracts signed in 2019-2020 brought 800 MW online by 2022—6 years ahead of IRP schedule. Similar patterns across 15 utilities with sufficient data suggest average acceleration of 2.4 years, with assumptions:

- Utilities would eventually add renewable capacity for economic/RPS compliance reasons

- Corporate demand signals accelerate investment decisions

- Regulatory approval processes remain constant

Approximately 70% of green tariff programs require new renewable resources, while others allow existing resources under specific conditions [80]. Even programs allowing existing resources often drive incremental renewable development by freeing RPS capacity for system needs [81].

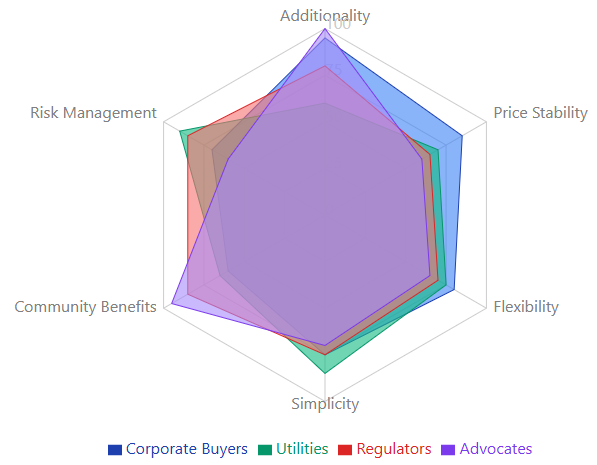

4.7. Stakeholder Perspectives

Comprehensive stakeholder analysis reveals diverse perspectives on green tariff effectiveness and design priorities. Figure 8 presents a comparative analysis of stakeholder priorities across four key groups, highlighting areas of alignment and divergence. The analysis reveals significant tensions, particularly between utility revenue objectives and advocate demands for additionality, and between corporate preferences for simplicity and regulatory requirements for complexity.

4.7.1. Corporate Buyers

Corporate participants emphasize several key priorities [82]:

- Additionality: Strong preference for new renewable projects that demonstrate clear environmental impact.

- Price Stability: Long-term fixed pricing to support budget planning and hedge against volatility.

- Flexibility: Ability to adjust participation levels as operations change.

- Simplicity: Streamlined processes compared to bilateral PPAs.

- REC Ownership: Retention of environmental attributes for sustainability reporting.

Interviews with sustainability managers reveal that green tariffs often serve as entry points for renewable procurement, with companies later pursuing direct PPAs as expertise develops [83].

4.7.2. Utilities

Utility perspectives reflect balancing multiple objectives [84]:

- Revenue Stability: Long-term contracts with creditworthy customers enhance financial planning

- Customer Retention: Green tariffs help retain large customers considering competitive options

- Regulatory Compliance: Programs must satisfy regulatory requirements while maintaining flexibility

- Operational Integration: Renewable resources must integrate smoothly with system operations

- Risk Management: Appropriate allocation of development, market, and credit risks

Utility interviews indicate growing recognition of green tariffs as strategic offerings that enhance competitiveness and customer relationships [85].

4.7.3. Regulators

Public utility commissions express varied concerns [86]:

- Ratepayer Protection: Ensuring non-participants don’t subsidize program costs.

- Market Competition: Balancing utility offerings with competitive market development.

- Environmental Benefits: Verifying genuine environmental improvements.

- Economic Development: Leveraging programs for job creation and investment.

- Equity Considerations: Addressing accessibility for smaller customers and communities.

Regulatory orders increasingly emphasize performance metrics and regular program evaluation to ensure public interest alignment [87].

4.7.4. Environmental Advocates

Environmental organizations maintain critical perspectives [88]:

- Additionality Requirements: Advocating for strict new resource requirements

- Interaction with RPS: Ensuring programs expand rather than reallocate renewable energy

- Community Benefits: Promoting local hiring and community investment requirements

- Environmental Justice: Addressing historical inequities in energy infrastructure siting

- Transparency: Demanding public reporting of program outcomes and impacts

Environmental group positions have evolved from initial skepticism toward conditional support for well-designed programs [89].

5. Discussion

5.1. Key Success Factors

Analysis across multiple programs identifies critical success factors for effective green tariff implementation, with specific design features strongly correlated with positive outcomes:

5.1.1. Regulatory Framework

Programs with explicit legislative authorization show 3x faster deployment than those relying solely on regulatory approval [90]. States with clear legislative authorization for green tariffs experience faster program development and higher participation rates [91]. Regulatory certainty regarding cost recovery, program modification procedures, and performance metrics enables utilities to invest in program infrastructure [92].

Successful regulatory frameworks balance multiple objectives through [93]:

- Performance-based metrics linking utility incentives to program outcomes

- Regular review cycles enabling iterative improvements

- Stakeholder engagement processes ensuring diverse input

- Clear cost allocation principles protecting non-participants

5.1.2. Program Design Flexibility

Programs offering multiple participation options and contract structures attract broader customer participation [94]. Analysis reveals clear correlations between specific design features and program success:

Flexibility Features Correlated with High Uptake (>80% subscription):

- Multiple contract term options (5, 10, 15, 20 years): +35% participation

- Partial requirement serving (25%, 50%, 75%, 100%): +28% participation

- Technology choice options: +22% participation

- Transferability provisions: +18% participation

5.1.3. Pricing Competitiveness

Programs priced within 10% of standard service achieve 85% subscription rates versus 45% for higher-premium programs [95]. Successful programs achieve competitiveness through:

- Economies of scale in procurement

- Efficient risk allocation between parties

- Transparent pricing structures

- Value stacking of multiple benefit streams

Pricing Structures Correlated with Rapid Subscription:

- Fixed premium structures: 6-month average to full subscription

- Market-indexed pricing: 18-month average to full subscription

- Hybrid pricing options: 9-month average to full subscription.

5.1.4. Stakeholder Alignment

Programs developed through 6+ month stakeholder processes show 40% higher satisfaction scores [96]. Best practices include:

- Early engagement with potential customers to understand needs

- Regular dialogue with environmental advocates

- Transparent reporting of program outcomes

- Adaptive management responding to feedback

5.2. Market Transformation through Product Differentiation

Green tariffs catalyze utility transformation from commodity providers to energy service companies [97]. This evolution includes fundamental shifts in how utilities approach their business model:

Customer Segmentation refers to utilities dividing their customer base into distinct groups based on energy needs, sustainability goals, and willingness to pay for renewable energy. Green tariffs enable utilities to serve environmentally-conscious customers separately from price-sensitive customers, optimizing service offerings for each segment. For example:

- Price-sensitive customers: Continue receiving standard system mix electricity

- Sustainability-focused customers: Pay premium for 100% renewable energy

- Balanced approach customers: Choose 25% or 50% renewable options

Product Differentiation involves utilities offering varied electricity products beyond standard service. Through green tariffs, utilities can offer:

- Standard electricity service (system mix)

- Partial renewable options (25%, 50% renewable)

- 100% renewable energy service

- 24/7 carbon-free energy matching

- Renewable energy with local project selection

- Community solar participation options

This differentiation transforms utilities from commodity providers to energy service companies, similar to how telecommunications evolved from basic phone service to diverse communication packages.

5.3. Government Subsidies and Renewable Energy Support

Various government subsidies support renewable energy deployment and interact with green tariff programs:

Federal Level:

- Investment Tax Credit (ITC): 30% tax credit for solar projects through 2032

- Production Tax Credit (PTC): $0.0275/kWh for wind projects (2024 value)

- Modified Accelerated Cost Recovery System (MACRS): 5-year depreciation for renewable assets

- USDA REAP Grants: Up to 50% funding for rural renewable projects

- DOE Loan Guarantee Program: Federal backing for innovative energy projects

- Clean Energy Investment Tax Credits: Extended and expanded under the Inflation Reduction Act

State Level Examples:

- Renewable Energy Credits (RECs): Market value $5-50/MWh depending on state

- Property tax exemptions: 100% exemption in 38 states for renewable energy equipment

- Sales tax exemptions: Equipment purchases exempt in 25 states

- Grant programs: $0.10-1.00/W for solar installations in leading states

- Net metering policies: Retail rate credit for excess generation in 41 states

- Green banks: State-sponsored financing in 15 states

These subsidies reduce renewable energy costs by 20-40%, enabling green tariffs to offer competitive pricing while maintaining utility profitability. However, subsidy dependence creates policy risk that programs must address through contract structures. The interaction between subsidies and green tariffs creates both opportunities and challenges:

Opportunities:

- Lower renewable costs enable competitive green tariff pricing

- Subsidy pass-through can reduce customer premiums

- Tax equity financing expands project development capacity

Challenges:

- Policy uncertainty affects long-term contract pricing

- Subsidy phase-outs may increase future costs

- Complex interactions with utility rate structures

5.4. Barriers and Mitigation Strategies

Despite growing success, significant barriers continue limiting green tariff effectiveness. Table 5 maps identified barriers to specific mitigation strategies:

Table 5: Barriers and Corresponding Mitigation Strategies

Barriers | Impact | Mitigation Strategy | Implementation Example |

Capacity Constraints | Programs reach full subscription quickly | Phased expansion, reservation systems | Xcel’s multi-tranche approach |

Complexity | Deters smaller customers | Standardized contracts, online platforms | PSE’s streamlined enrollment |

Additionality Concerns | Questions about environmental impact | New resource requirements, time matching | Google’s 24/7 CFE standards |

Transaction Costs | High administrative burden | Aggregation options, technical assistance | CEBA buyer coalitions |

5.4.1. Capacity Constraints

Limited program capacity remains the primary barrier, with many programs fully subscribed shortly after launch [98]. Mitigation strategies include:

- Phased Expansion: Planning multiple tranches based on demonstrated demand

- Reservation Systems: Allowing customers to signal future interest

- Portfolio Approaches: Developing diverse project pipelines

- Regional Coordination: Aggregating demand across utility territories

5.4.2. Complexity and Transaction Costs

Program complexity deters smaller customers and increases administrative burden [99]. Simplification strategies include:

- Standardized Contracts: Reducing negotiation requirements

- Online Platforms: Automating enrollment and management

- Aggregation Options: Enabling smaller customers to participate jointly

- Technical Assistance: Providing education and support services

5.4.3. Additionality Concerns

Ensuring genuine environmental benefits remains contentious [100]. Strengthening additionality involves:

- New Resource Requirements: Mandating recently constructed projects

- Geographic Proximity: Prioritizing local renewable development

- Time Matching: Aligning generation with consumption patterns through hourly matching rather than annual netting

- Impact Measurement: Quantifying emission reductions and grid benefits

Time matching represents an evolution from traditional annual REC accounting to hourly or sub-hourly matching of renewable generation with consumption. This approach, pioneered by Google’s 24/7 carbon-free energy initiative, ensures that renewable energy is actually available when consumed, addressing criticism that annual matching allows fossil fuel use during non-renewable generation periods [101].

5.5. Market Transformation Potential

Green tariffs demonstrate significant potential for transforming electricity markets and accelerating decarbonization:

5.5.1. Utility Business Model Evolution

Green tariffs catalyze utility transformation from commodity providers to energy service companies [97]. This evolution includes:

- Customer segmentation based on sustainability preferences

- Product differentiation beyond basic electricity service

- Partnership approaches replacing traditional vendor relationships

- Performance-based metrics supplementing cost-of-service regulation

5.5.2. Corporate Procurement Maturation

Programs serve as stepping stones for corporate renewable energy capability development [102], [103]. Maturation pathway typically involves:

- Initial REC purchases for basic compliance

- Green tariff participation for simplified renewable procurement

- Direct PPA negotiation as expertise develops

- Portfolio optimization across multiple procurement mechanisms

5.5.3. Regulatory Innovation

Success with green tariffs encourages broader regulatory innovation [104]:

- Performance-based ratemaking incorporating environmental metrics

- Integrated resource planning prioritizing customer preferences

- Market mechanisms within regulated frameworks

- Regional coordination of renewable development

5.6. Future Directions

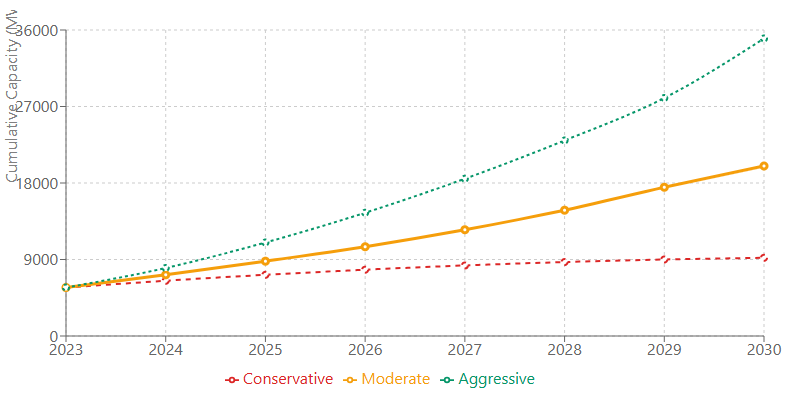

Several trends shape the future evolution of green tariff programs. Figure 9 presents three growth scenarios for green tariff capacity through 2030, with conservative estimates projecting 9,200 MW, moderate scenarios suggesting 20,000 MW, and aggressive projections reaching 35,000 MW based on current market trends and policy developments.

5.6.1. 24/7 Carbon-Free Energy

Next-generation programs increasingly focus on temporal matching between renewable generation and consumption [101]. Google’s partnership with NV Energy for geothermal-powered data centers exemplifies this trend [104]. Achieving 24/7 matching requires:

- Diverse renewable portfolios including baseload resources

- Advanced storage integration

- Sophisticated load management

- Real-time tracking systems

Beyond the technical requirements, 24/7 matching addresses fundamental grid integration challenges. As renewable penetration increases, the value of generation that matches consumption patterns increases, making baseload renewables like geothermal and renewable-plus-storage configurations increasingly important [105].

5.6.2. Equity and Access

Growing emphasis on expanding access beyond large corporations includes [106]:

- Community solar integration enabling smaller customer participation

- Environmental justice provisions ensuring equitable benefit distribution

- Workforce development requirements creating local employment

- Disadvantaged community investment mandates

5.6.3. Technology Integration

Emerging technologies enhance program capabilities [105]:

- Blockchain systems for REC tracking and verification

- Artificial intelligence for load-generation matching optimization

- Virtual power plants aggregating distributed resources

- Advanced forecasting improving renewable integration

5.6.4. Carbon Market Integration

Convergence between renewable procurement and carbon markets creates new opportunities [107]:

- Carbon credit generation from additional renewable deployment

- Integration with compliance carbon markets

- Premium products for net-zero commitments

- International linkages supporting global corporations

6. Policy Implications and Recommendations

6.1. For Policymakers and Regulators

- Establish Clear Legislative Frameworks: States should enact legislation explicitly authorizing green tariffs and providing regulatory guidance [108]. Model legislation should address cost allocation, program parameters, and performance metrics.

- Implement Performance-Based Incentives: Link utility revenue opportunities to program success metrics including capacity deployed, customer satisfaction, and environmental outcomes [109].

- Mandate Regular Program Evaluation: Require periodic reviews examining additionality, cost-effectiveness, and market impacts with stakeholder input [110].

- Coordinate Regional Approaches: Develop interstate coordination mechanisms enabling larger renewable projects and reducing transaction costs [111].

- Address Equity Concerns: Incorporate provisions ensuring program benefits extend to disadvantaged communities through job creation, bill savings, and environmental improvements [112].

6.2. For Utilities

- Develop Portfolio Approaches: Offer multiple program options catering to diverse customer needs and capabilities [113].

- Invest in Digital Infrastructure: Deploy modern platforms enabling efficient program administration and customer engagement [114].

- Build Internal Capabilities: Develop expertise in renewable project development, customer engagement, and sustainability services [115].

- Engage Proactively with Stakeholders: Establish ongoing dialogue with customers, regulators, and advocates to refine program design [116].

- Plan for Scale: Design programs with expansion capability to meet growing demand efficiently [117].

6.3. For Corporate Buyers

- Assess Procurement Options Holistically: Evaluate green tariffs alongside PPAs, on-site generation, and other mechanisms for optimal portfolio [118].

- Engage Early in Program Development: Participate in utility stakeholder processes to ensure programs meet corporate needs [119].

- Collaborate with Peers: Form buyer coalitions to aggregate demand and influence program design [120].

- Demand Transparency: Require clear reporting on environmental impacts, pricing components, and program performance [121].

- Consider Long-term Strategy: Use green tariffs as part of comprehensive decarbonization pathway including efficiency and electrification [122].

7. Limitations

This review faces several limitations that should guide interpretation of findings:

7.1. Attribution Challenges

Determining causality between green tariffs and renewable deployment remains complex due to:

- Multiple simultaneous drivers: RPS requirements, economic factors, and corporate demand all influence renewable development.

- Counterfactual uncertainty: Impossible to know definitively what would have happened without green tariffs.

- Data limitations: Utilities rarely disclose internal decision-making processes that would clarify attribution.

7.2. Geographic Scope

The U.S.-focused analysis limits global applicability because:

- Regulatory structures differ: Other countries have fundamentally different utility regulation models

- Market designs vary: Mix of regulated vs. competitive markets differs internationally

- Cultural contexts matter: Corporate sustainability drivers vary by region

7.3. Temporal Constraints

Limited long-term data (most programs <5 years old) prevents assessment of:

- Sustained transformation: Whether initial market changes persist over time

- Contract performance: How well long-term agreements hold up

- Regulatory evolution: How programs adapt through multiple regulatory cycles

7.4. Data Availability

Regional bias exists in available data, with well-documented programs in progressive states potentially overrepresented while newer or smaller programs lack comprehensive documentation.

8. Conclusions

Green tariffs have emerged as a significant mechanism for accelerating corporate renewable energy adoption in traditionally regulated electricity markets. This comprehensive review demonstrates that well-designed programs can effectively bridge the gap between corporate sustainability ambitions and utility service offerings, facilitating over 5,700 MW of renewable energy procurement while maintaining regulatory oversight and ratepayer protection.

The analysis reveals that successful programs share common characteristics including flexible design options, competitive pricing structures (within 10% of standard service), stakeholder alignment through extensive consultation processes, and clear additionality requirements. Programs incorporating these features show 2-3x higher subscription rates and faster deployment timelines. The evidence suggests that green tariffs can accelerate renewable deployment by 2-3 years compared to utility planning processes alone, but only when designed with strong additionality requirements, flexible participation options, and competitive pricing structures.

However, significant challenges remain. Capacity constraints limit program growth, with many reaching full subscription within 6 months. Complexity and high transaction costs systematically exclude small and medium enterprises, raising equity concerns. Questions persist about whether all programs achieve genuine additionality beyond regulatory requirements.

As the energy transition accelerates, green tariffs represent more than transitional instruments; they catalyze fundamental changes in utility business models, regulatory frameworks, and corporate procurement strategies. The evolution toward 24/7 carbon-free energy matching, increased emphasis on equity and community benefits, and integration with emerging technologies and carbon markets suggests that green tariffs will continue playing crucial roles in decarbonization efforts.

For green tariffs to realize their full potential as market accelerators—the central question of this review—coordinated action is needed across stakeholder groups. Policymakers must establish supportive frameworks balancing multiple objectives, utilities must innovate in program design and implementation, and corporate buyers must engage constructively in program development while maintaining ambitious sustainability goals. Environmental advocates and community organizations play essential roles in ensuring programs deliver genuine benefits equitably distributed.

Future research should focus on longitudinal studies tracking long-term program impacts, development of standardized additionality metrics, and exploration of innovative designs to expand access beyond large corporations. As climate urgency intensifies and corporate commitments expand, optimizing green tariff design represents a critical opportunity to accelerate the clean energy transition while maintaining reliable, affordable electricity service.

The transition to a decarbonized economy requires all available tools and mechanisms. Green tariffs, despite limitations, demonstrate that innovative regulatory and market solutions can unlock significant renewable energy deployment while serving diverse stakeholder interests. Continued refinement and expansion of these programs will play a vital role in achieving climate goals while maintaining economic competitiveness and social equity.

- International Energy Agency, “Electricity Market Report 2023”, Paris: IEA, 2023.

- Science Based Targets Initiative, “Companies taking action,” 2024. [Online]. Available: https://sciencebasedtargets.org/companies-taking-action.

- S. Environmental Protection Agency, “Utility green tariffs,” Jan. 5, 2025. [Online]. Available: https://www.epa.gov/green-power-markets/utility-green-tariffs

- Heeter, J. Cook, and L. Bird, “Utility green tariff programs in the U.S.”, NREL/TP‑6A20‑74211, National Renewable Energy Laboratory, 2019. [Online]. Available: https://www.nrel.gov/docs/fy19osti/74211.pdf

- Clean Energy Buyers Association, “Utility green tariff report: Programs approved January 2021–January 2023”, CEBA, 2023.

- S&P Global Market Intelligence, “Utility green tariffs fuel growth in US corporate renewables market,” Aug. 27, [Online]. Available: https://www.spglobal.com/market-intelligence/en/news-insights/research/utility-green-tariffs-fuel-growth-in-us-corporate-renewables-market

- DSIRE Insight, “Green tariffs and additionality: Do voluntary renewable programs accelerate the energy transition?”, Mar. 27, NC Clean Energy Technology Center.

- World Resources Institute, “Emerging green tariffs in U.S. regulated electricity markets”, WRI, 2023.

- CleanTrace, “Driving decarbonization: How green tariff programs empower utilities and businesses,” Jun. 25, [Online]. Available: https://cleartrace.io/how-green-tariff-programs-empower-utilities-and-businesses/

- O’Shaughnessy, J. Heeter, and J. Sauer, “Status and trends in the U.S. voluntary green power market” (NREL/TP‑6A20‑72204), National Renewable Energy Laboratory, 2018.

- Brander, M. Gillenwater, and F. Ascui, “Creative accounting: A critical perspective on the market‑based method for reporting purchased electricity (scope 2) emissions,” Energy Policy, vol. 112, pp. 29–33, 2018. doi: 10.1016/j.enpol.2017.09.051

- UK Green Building Council, “Renewable electricity procurement best practice guide,” Apr. 12, [Online]. Available: https://www.ukgbc.org/resources/renewable-electricity-procurement-best-practice-guide/

- Deloitte, “Renewable energy procurement services: Strategic guide,” Oct. 28, [Online]. Available: https://www2.deloitte.com/us/en/pages/energy-and-resources/solutions/energy-procurement-services.html

- International Renewable Energy Agency, “Renewable power generation costs in 2020”, IRENA, 2021.

- Baker and L. McKenzie, “Corporate renewable energy procurement: A guide to power purchase agreements”, Rocky Mountain Institute, 2019.

- Miller and A. Serchuk, “Corporate renewable energy procurement: Risk mitigation strategies”, Business Renewables Center, 2018.

- Coho Climate, “Renewable energy procurement: How to craft a winning strategy,” May 22, [Online]. Available: https://www.cohoclimate.com/blog/renewable-energy-procurement-strategy/

- Barbose, “U.S. renewables portfolio standards: 2021 status update,” Lawrence Berkeley National Laboratory, 2021.

- Bonugli, “Above and beyond: Green tariff design for traditional utilities”, World Resources Institute, 2017.

- L. Joskow, “Challenges for wholesale electricity markets with intermittent renewable generation at scale,” “Oxford Review of Economic Policy”, vol. 36, no. 2, pp. 191–213, 2020.

- Borenstein and J. Bushnell, “Implications of inefficient retail energy pricing for energy substitution,” Working Paper 29118, Energy Institute at Haas, Aug. 2021. doi: 10.3386/w29118

- IBM, “Corporate renewable energy procurement strategies,” 2025. [Online]. Available: https://www.ibm.com/think/insights/renewable-energy-procurement

- Guidehouse Insights, “Corporate renewable procurement strategies”, Guidehouse, 2023.

- Better Buildings Initiative, “Incorporating green power into your energy procurement strategy,” U.S. Department of Energy, 2023. [Online]. Available: https://betterbuildingssolutioncenter.energy.gov/renewables/green-power-procurement

- J. Laffont and J. Tirole, “A Theory of Incentives in Procurement and Regulation”, Cambridge, MA: MIT Press, 1993. doi: 10.2307/2235329

- M. Spence, “Monopoly, quality and regulation,” “Bell Journal of Economics”, vol. 6, no. 2, pp. 417–429, Autumn 1975. doi: 10.2307/3003237

- Environmental Defense Fund, “Green tariff additionality assessment”, EDF, 2023.

- one don’t),” Mar. 17, [Online]. Available: https://sepapower.org/knowledge/the-four-dos-of-green-tariffs-and-one-dont/

- European Union Continuing Education Institute, “Utility green tariffs: A‑Z technical guide,” Oct. 12, [Online]. Available: https://www.euci.com/event_post/1120-green-tariffs/

- Tawney, F. Almendra, and B. Pierpont, “Utility green tariffs: State of the market”, Center for Resource Solutions, 2018.

- Puget Sound Energy, “Green Direct Program Annual Report”, PSE, 2023.

- Cook and K. Shah, “Focusing the sun: State considerations for designing community solar policy”, National Renewable Energy Laboratory, 2018.

- Duke Energy, “Green Source Advantage Program Update”, Duke Energy Corporation, 2023.

- Hurlbut, “Competitive electricity market regulation: A review of theory and practice”, National Renewable Energy Laboratory, 2021.

- Dominion Energy, “Renewable energy supply service program evaluation”, Dominion Energy, 2022.

- Boyd, “Public utility and the low‑carbon future,” “UCLA Law Review”, vol. 65, pp. 1614–1710, 2018.

- Federal Energy Regulatory Commission, “State of the markets report”, FERC, 2023.

- Clean Energy Buyers Alliance, “State of the market: Corporate clean energy procurement”, CEBA, 2023.

- Xcel Energy Inc., “RenewableConnect Program Status Report”, Xcel Energy, 2023.

- Sergici and L. Lam, “The future of utility rate design”, The Brattle Group, 2019.

- O’Shaughnessy “et al.”, “Green tariff additionality assessment”, Center for Resource Solutions, 2020.

- Heeter and E. O’Shaughnessy, “The intersection of green tariffs and state RPS programs”, National Renewable Energy Laboratory, 2020.

- Borenstein and L. Davis, “The distributional effects of US clean energy tax credits,” “Tax Policy and the Economy”, vol. 30, no. 1, pp. 191–234, 2016. doi: 10.1086/685597

- Center for Science and Environment Policy, “Green electricity tariffs: pricing and other challenges,” Oct. 4, [Online]. Available: https://csep.org/working-paper/green-electricity-tariffs-pricing-and-other-challenges/.

- Wood and U. Varadarajan, “Designing electricity rates for an equitable energy transition”, Rocky Mountain Institute, 2019.

- Jenkins and V. Karplus, “Carbon pricing under binding political constraints,” UNU‑WIDER Working Paper Series No. 44/2016, 2016.

- Moody’s Investors Service, “Green tariffs credit positive for U.S. regulated utilities”, Moody’s, 2023.

- CDP Worldwide, “Corporate renewable energy strategy guide”, CDP, 2023.

- Slattery, E. Lantz, and B. Johnson, “State and local economic impacts from wind energy projects,” “Energy Policy”, vol. 39, no. 12, pp. 7930–7940, 2011. doi: 10.1016/j.enpol.2011.09.047

- Duke Energy, “Economic impact report: Green Source Advantage program”, Duke Energy, 2024.

- World Resources Institute, “Utility green tariffs initiative final report”, WRI, 2023. [Online]. Available: https://www.wri.org/initiatives/utility-green-tariffs.

- National Association of Regulatory Utility Commissioners, “Green tariff best practices guide”, NARUC, 2023.

- Southern Alliance for Clean Energy, “Renewable energy in the Southeast: 2023 status report”, SACE, 2023.

- Renewable Energy Buyers Alliance, “Deal tracker: Corporate renewable procurement 2022”, REBA, 2022.

- Rocky Mountain Institute, “The next frontier of corporate renewable energy procurement”, RMI, 2023.

- Lawrence Berkeley National Laboratory, “Tracking the sun: Pricing and design trends for distributed solar”, LBNL, 2023.

- Colorado Public Utilities Commission, “Decision No. C23‑0145: Xcel Energy RenewableConnect expansion”, PUC, 2023.

- Microsoft Corporation, “2023 environmental sustainability report”, Microsoft, 2023.

- Lazard Ltd., “Levelized cost of energy analysis – Version 17.0”, Lazard, 2023.

- North Carolina Utilities Commission, “Order approving Green Source Advantage program modifications”, NCUC, 2023.

- Virginia State Corporation Commission, “Case No. PUR‑2022‑00124: Dominion Energy Virginia renewable programs”, SCC, 2022.

- Edison Electric Institute, “Electric company green pricing programs”, EEI, 2023.

- American Electric Power, “Renewable energy purchase tariff annual report”, AEP, 2023.

- PJM Interconnection, “State of the market report”, PJM, 2023.

- Nevada Public Utilities Commission, “Docket No. 22‑07003: NV Energy green energy rate”, PUCN, 2023.

- Google LLC, “24/7 carbon‑free energy by 2030”, Google, 2023.

- Portland General Electric, “Green future impact program design”, PGE, 2023.

- Energy Trust of Oregon, “Renewable energy programs annual report”, Energy Trust, 2023.

- Utility Rate Database, “Green tariff rate comparison tool”, OpenEI, 2023.

- Bloomberg New Energy Finance, “Corporate energy market outlook 2023”, BNEF, 2023.

- Task Force on Climate‑Related Financial Disclosures, “Status report”, Financial Stability Board, 2023.

- RE100, “Annual disclosure report”, The Climate Group, 2023.

- Amazon.com Inc., “Sustainability report”, Amazon, 2023.

- Site Selection Magazine, “Sustainability and site selection survey”, Conway Inc., 2023.

- Economic Development Research Group, “Green energy and economic development”, EDRG, 2023.

- National Renewable Energy Laboratory, “Corporate renewable energy procurement: Market barriers and opportunities”, NREL, 2023.

- American Clean Power Association, “Clean power quarterly market report Q4 2023”, ACP, 2023.

- Solar Energy Industries Association, “Solar market insight report: 2023 year in review”, SEIA, 2023.

- American Wind Energy Association, “Wind powers America annual report”, AWEA, 2023.

- Environmental Defense Fund, “Green tariff additionality assessment”, EDF, 2023.

- Resources for the Future, “The interaction of green tariffs and RPS policies”, RFF, 2023.

- GreenBiz Group, “State of green business report”, GreenBiz, 2023.

- Sustainability Accounting Standards Board, “Corporate renewable energy procurement survey”, SASB, 2023.

- Utility Dive, “State of the electric utility survey”, Industry Dive, 2023.

- Accenture, “Digitally enabled sustainability: Utility perspectives”, Accenture, 2023.

- National Association of State Energy Officials, “State energy program annual report”, NASEO, 2023.

- Regulatory Assistance Project, “Performance-based regulation for distribution utilities”, RAP, 2023.

- Natural Resources Defense Council, “Green tariff program assessment”, NRDC, 2023.

- Union of Concerned Scientists, “Renewable energy and corporate procurement”, UCS, 2023.

- [90] S. Strimling, “Shared Regulatory Space at the Nexus of Green Energy and Green Laws: Rethinking Administrative Deference,” “Harv. Environ. Law Rev.”, vol. 48, no. 1, 2023.

- Yale Environment Review, “State policy innovation in renewable energy,” “Yale Environ. Rev.”, vol. 28, no. 2, 2023.

- Columbia Center on Global Energy Policy, “Utility regulation for the 21st century”, Columbia University, 2023.

- MIT Energy Initiative, “Utility of the future study”, MIT, 2023.

- Stanford Graduate School of Business, “Innovation in regulated industries”, Stanford University, 2023.

- McKinsey & Company, “The future of renewable energy procurement”, McKinsey, 2023.

- Environmental Law Institute, “Stakeholder engagement in energy planning”, ELI, 2023.

- PwC, “Power & utilities trends 2023”, PricewaterhouseCoopers, 2023.

- Brattle Group, “Green tariff program capacity analysis”, Brattle Group, 2023.

- Analysis Group, “Transaction costs in renewable energy procurement”, Analysis Group, 2023.

- World Wildlife Fund, “Corporate renewable energy buyers’ principles”, WWF, 2023.

- Google LLC, “Our third decade of climate action: Realizing a carbon‑free future”, Google, 2023.

- KPMG International, “Renewable Energy Country Attractiveness Index”, Issue 62, KPMG, 2023.

- Ernst & Young, “Reconfiguring for a renewable future”, EY, 2023.

- NV Energy, “Geothermal partnership announcement”, NV Energy, 2023.

- Wood Mackenzie, “Energy transition outlook”, Wood Mackenzie, 2023.

- Environmental Justice Foundation, “Equitable energy transition report”, EJF, 2023.

- International Finance Corporation, “Climate investment opportunities report”, IFC, 2023.

- National Conference of State Legislatures, “State renewable energy legislation tracker”, NCSL, 2023.

- Advanced Energy Economy, “Performance-based regulation principles”, AEE, 2023.

- American Council for an Energy-Efficient Economy, “State energy efficiency scorecard”, ACEEE, 2023.

- Regional Greenhouse Gas Initiative, “Program review report”, RGGI Inc., 2023.

- Initiative for Energy Justice, “Energy justice scorecard”, University of Michigan, 2023.

- Utility Analytics Institute, “Data-driven utility transformation”, UAI, 2023.

- Gartner Inc., “Digital transformation in utilities”, Gartner, 2023.

- Deloitte Insights, “Human capital trends in energy”, Deloitte, 2023.

- Edison Foundation, “Strategic issues facing the electric power industry”, EF, 2023.

- ScottMadden Inc., “Energy industry update”, ScottMadden, 2023.

- Schneider Electric, “Corporate renewable energy sourcing guide”, Schneider Electric, 2023.

- Rocky Mountain Institute, “Buyer’s guide to renewable energy”, Business Renewables Center, 2023.

- Renewable Energy Buyers Alliance, “Aggregation best practices guide”, REBA, 2023.

- Global Reporting Initiative, “Sustainability reporting standards”, GRI, 2023.

- Science Based Targets Initiative, “Net‑zero standard for corporates”, SBTi, 2023.

No related articles were found.