Linking Consumer Innovativeness to the Cryptocurrency Intention: Moderating Effect of the LOHAS (Lifestyle of Health and Sustainability) Lifestyle

Journal of Engineering Research and Sciences, Volume 1, Issue 12, Page # 1-6, 2022; DOI: 10.55708/js0112001

Keywords: Cryptocurrency, consumer innovativeness, LOHAS, Lifestyle of health and sustainability, attitude, intention

(This article belongs to the Special Issue on SP1 (Special Issue on Multidisciplinary Sciences and Advanced Technology 2022) and the Section Ergonomics (ERG))

Export Citations

Cite

Choi, S. and Feinberg, R. A. (2022). Linking Consumer Innovativeness to the Cryptocurrency Intention: Moderating Effect of the LOHAS (Lifestyle of Health and Sustainability) Lifestyle. Journal of Engineering Research and Sciences, 1(12), 1–6. https://doi.org/10.55708/js0112001

Sooyeon Choi and Richard A. Feinberg. "Linking Consumer Innovativeness to the Cryptocurrency Intention: Moderating Effect of the LOHAS (Lifestyle of Health and Sustainability) Lifestyle." Journal of Engineering Research and Sciences 1, no. 12 (December 2022): 1–6. https://doi.org/10.55708/js0112001

S. Choi and R.A. Feinberg, "Linking Consumer Innovativeness to the Cryptocurrency Intention: Moderating Effect of the LOHAS (Lifestyle of Health and Sustainability) Lifestyle," Journal of Engineering Research and Sciences, vol. 1, no. 12, pp. 1–6, Dec. 2022, doi: 10.55708/js0112001.

Cryptocurrency is gaining worldwide recognition. This research examines the role of personality and psychological factors in consumers’ cryptocurrency adoption behavior. 452 samples are collected from U.S consumers and the data are analyzed by PLS-SEM. The findings reveal that consumer innovativeness has a positive influence on the intention to use cryptocurrency and its impact is partially mediated by attitude. The LOHAS lifestyle moderated the influence of consumer innovativeness on the cryptocurrency intention as well as the relation of attitude with the intention. This research provides theoretical and practical implications for the cryptocurrency market.

1. Introduction

Cryptocurrency is an innovative and rapidly growing issue in today’s digital economy [1]. It is a decentralized digital currency that is based on blockchain technology that uses cryptography to secure and manage the circulation of digital coins [2], [3]. Not only the celebrities like Elon Musk and Bill Gates began to support this but also the general population realized the promise of the cryptocurrency market and began to seek an alternative financial means because it can be used to buy tangible products rather than merely for trading and investing during the pandemic [4], [5]. In 2022 the total value of cryptocurrency transactions will surpass $10 billion for the first time, which is an increase of more than 70% from 2021, and a double-digit increase in the U.S adults who possess and use cryptocurrency for payments is expected by 2023 [6].

The Natural marketing institute (NMI) coined the terminology of LOHAS (Lifestyle of health and sustainability) to define the rapid growth of global cultural trend that emphasizes the values of personal health and well-being, and environmental sustainability [7]. The LOHAS consumer segment strives to live healthy and sustainable lives and make conscious choices by considering the environmental and social impact of their consumption beyond their personal well-being [8]. Furthermore, they are early adopters who are willing to try and adopt new products and technologies considerably more than any other segment [9]. In line with this, the author pointed out that virtual grocery stores, mobile shopping, and electric transportation as LOHAS technological trends, reflecting the LOHAS consumer’s technology-friendly disposition [10]. In 2022 the LOHAS consumers account for one-third of the entire U.S. adult population, and the total U.S. LOHAS configurable market is estimated to reach $472.51 billion, being expected to grow at 10% each year [11].

Whereas the majority of research on cryptocurrency has been conducted in technology, computer science, and engineering [12], the studies in marketing devoted to better understanding consumers’ inner mechanism that drives to use of cryptocurrency are rare despite its potential for strategic applications of the businesses. Although limited marketing literature revealed some psychological factors (e.g., self-efficacy, emotion) as a primary motive for cryptocurrency adoption within the theory of planned behavior (TPB), to our best knowledge no research emphasized the role of consumer innovativeness in conjunction with TPB despite its importance in predicting technology acceptance [13]. Furthermore, while distinctive behavioral characteristics of the LOHAS consumers in a wide range of market sectors such as personal health (e.g., organic food), natural lifestyle (e.g., apparel), alternative energy and transportation (e.g., electric vehicles), green building, and ecotourism are well studied [11], research on their technological behavior lacks empirical evidence despite conceptual inference on it.

Considering the academic’s call for more empirical studies in marketing on cryptocurrency behavior, a better understanding is needed of what drives consumers to use cryptocurrency. Furthermore, given the growing impact of LOHAS on a wide range of consumption patterns, the examination of the role of LOHAS in cryptocurrency usage behavior will provide rich insights into the technology context. Therefore, this research addresses the following two research questions: 1) What are the roles of consumer innovativeness and attitude toward cryptocurrency in the intention to use cryptocurrency? 2) How does the impact of consumer innovativeness and attitude on cryptocurrency intention differ depending on the level of the LOHAS lifestyle?

This research provides theoretical and practical implications in several ways. First, while past research focused on affective and cognitive factors as antecedents for cryptocurrency adoption, this research additionally incorporates consumer innovativeness as a personality trait, which has been proven to be relevant for technology adoption. Beyond that, LOHAS is introduced as a new important inferential factor for cryptocurrency utilization. Second, while past literature conceptually inferred the technology enthusiastic characteristic of the LOHAS consumers, this study contributes to the body of knowledge by providing empirical evidence on their nature. Finally, businesses in the well-being and sustainability market may consider utilizing cryptocurrency as an alternative transaction method to capture the attention of LOHAS consumers.

2. Literature Review and Hypothesis Development

2.1. Consumer Innovativeness and Cryptocurrency Intention

Consumer innovativeness refers to the willingness to adapt to changes and experience new things [14]. Innovative consumers are more likely to purchase new or different products more quickly and frequently, deriving pleasure from exploring different things and trying new experiences[15], [16]. A psychological profile of innovative consumers has been described as ambiguity-tolerant, and risk-taking [17]. The importance of consumer innovativeness as a motive for technology usage has been emphasized in the literature [13]. For example, in [18], the authors found that those with a high level of IT innovativeness tend to adopt blockchain technology applications. In [19], the authors found that more innovative consumers have a significantly higher increase in satisfaction with cryptocurrency, compared to traditional compensation types. The result shows the technological savvy of innovative consumers given that crypto-compensation is digital currency-based, which entails the use of complicated algorithms [20].

H1: Consumer innovativeness positively influences the intention to adopt cryptocurrency.

2.2. Consumer Innovativeness and Attitude toward Cryptocurrency

Attitude is defined as “the degree to which a person has a favorable or unfavorable evaluation or appraisal of the behavior in question” and it determines the way that consumers behave in a particular way toward an object [21]. Inherent innovativeness enables people to be open to new stimuli and ideas [22], and this in turn leads people to be more readily perceived the benefits and value of adopting innovation [23]. Concerning the relationship between consumer innovativeness and attitude toward the innovative product, the author in [24] argued that novelty-seeking consumers view technical products positively, and have a stronger intrinsic motivation to acquire such products [25], [16] because they are less concerned about whether new technologies are easy to use or trustworthy for their risk and uncertainty taking predispositions [26], [27].

H2: Consumer innovativeness positively influences the attitude toward adopting cryptocurrency

2.3. Attitude and Intention to Cryptocurrency

Many scholars in the area of consumer behavior have discussed the importance of attitude in determining an individual’s decisions and behavior (e.g., [28], [29]). For example, particularly in the technology utilization context, in [30] the authors found that the more one has a positive attitude toward Bitcoin, the one is more likely to intend to adopt Bitcoin. In [31] the authors also revealed that attitude has a strong positive influence on the customer’s behavioral intention to use blockchain-based cryptocurrency transactions. In a similar vein, the author in [32] also revealed that attitude toward digital theft is positively associated with that behavior.

H3: Consumer attitude positively influences the intention to use cryptocurrency.

2.4. Mediating Effect of Attitude in the Relationship between Consumer Innovativeness and Intention.

Innovators perceive a value created in the innovative products and adopt new products[23]. They tend to evaluate novelty, ease of use, and functional performance of the technologies differently than the majority of late consumers, which influences their behavioral intention [33]. For example, in [34] the authors found that eight subdomains of consumer innovativeness positively affect the intention to use and pay a price premium for drone food delivery services through a positive attitude. In [35], the authors revealed that consumer innovativeness is positively associated with the perceived financial benefits of adopting electric vehicles (EV). Similarly, in [36] the authors discovered a positive influence of consumers’ innovativeness on the intention to use smartwatches through the perceived utilitarian and hedonic values.

H4: Consumer attitude mediates the relationship between consumer innovativeness and the intentions of adopting cryptocurrency.

2.4. Moderating Role of LOHAS

The LOHAS literature extensively mentioned the innovative and technology savvy characteristics of the LOHAS consumers. As early adopters who seek out the latest information, formulas, and innovative technologies [37], LOHAS consumers usually adopt and try a new product earlier than their family members or others in their social circle [38]. They not only incorporate the new product into their lifestyles but also influence their families and friends to try it [39]. They are expected to possess higher innovativeness compared to others in the later stages of adoption [40], and this may positively influence their intention to adopt an innovative technology [41].

H5a: LOHAS moderates the effect of consumer innovativeness on intention to cryptocurrency.

H5b: LOHAS moderates the effect of consumer innovativeness on attitude.

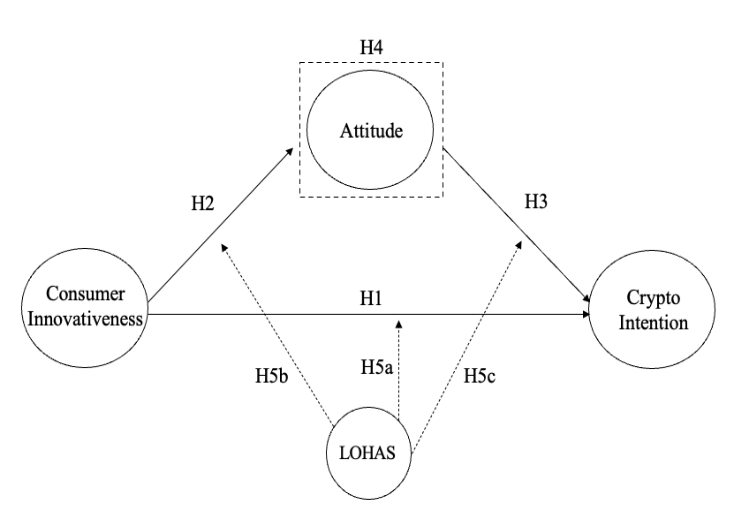

H5c: LOHAS moderates the effect of attitude on intention to cryptocurrency. Figure 1 describes the research model.

3. Methodology

3.1. Participants and Data Collection

Amazon Mechanical Turk (MTurk) is employed to recruit subjects of the general U.S population aged between 18 and 65. Five hundred surveys were distributed, and four hundred fifty-two surveys were used after excluding incomplete and invalid responses. The demographic profiles of the respondents are provided in Table 3.

3.2. Measures

The constructs included in the theoretical model are consumer innovativeness, consumer attitude, cryptocurrency intention, and LOHAS. The questions for consumer innovativeness were adopted from [42] which measures the concept using a 5-point Likert scale (from 1, completely disagree, to 5, completely agree). The attitude measures were adopted from the study of [43]. The questions that measured cryptocurrency intention came from the study of [44]. The LOHAS questions were adopted from [4] which measures the level of individual well-being and sustainability orientation with 28 items.

3.3. Two Groups: LOHAS Lifestyle

We had two groups of LOHAS based on a quartile split (we dropped the two middle groups and focused on the 1st and 4th quartiles.)[45]. The low LOHAS score in the 1st quartile of the LOHAS distribution and the high LOHAS score in the 4th quartile. The 1st quartile of the LOHAS distribution (i.e., low LOHAS group) consisted of 117 participants, and they showed a lower level of belief and attitudinal and behavioral patterns for personal health and well-being and sustainability (M=74.8, p <. 001). On the other hand, the 4th quartile (i.e., high LOHAS group) was made up of 106 participants and they indicated not only a high level of personal well-being in diverse life domains but also a strong sense of sustainability (M= 112.4, p <. 001).

3.4. Data Analysis

Smart-PLS 3.0 was utilized to test the psychometric quality of the measurements and the path links between the latent constructs in the research model. The Smart-PLS gained popularity in marketing and management research for decades as a well-established method for the coefficient estimation of the structural model[46]. Convergent and discriminant validity were assessed, and for more rigorous reliability tests composite reliability (CR) and average variance extract (AVE) were examined thereafter. Finally, the path coefficients of the structural model were estimated using PLS-SEM.

4. Results

4.1. Measurement Model Assessment

The measurement model was evaluated based on the criteria of internal consistency, convergent validity, and discriminant validity [47], [48]. The variables’ reliability was assessed using Cronbach’s alpha and was found to be satisfactory. The convergent validity of the variables was tested using factor loadings, composite reliability (CR), and average variance extracted (AVE) and the results showed that factor loadings for the items on each construct exceed the threshold of 0.70, CR values of each construct are greater than 0.7, and AVEs for all constructs are greater than the cut-off value of 0.5 [49]. This demonstrated that convergent validity is established in the complete and split two samples. The discriminant validity was evaluated based on the Heterotrait-Monotrait (HTMT) ratio of correlation on the complete and split data sets. The discriminant validity was established given that HTMT ratios are under the cut-off of 0.85 [49]. In addition, model fit was evaluated using standardized root mean square residual (SRMR) and values are less than the threshold of 0.8; 0.036 for complete data, 0.039 for the low LOHAS group, and 0.08 for high LOHAS group, indicating the satisfaction of the requirements for goodness-of-fit [50]. Table1 displays the results.

4.2. Descriptive Statistics

The sample was comprised of 282 males (62.4%) and 170 females (37.6%). Consumers aged between 26 and 35 comprised 39.2% of the sample (n= 177), followed by people aged between 36 and 45 (29.9%), and between 46 and 55 (13.3%). For education, 50% of the sample were college graduates (n=226), followed by graduate school graduates (26.8%), and high school (21.7%). Annual income less than $29,999 made up of 29.7% of the total sample, followed by $30,000 – $49,999 (25.2 %), $50,000 – $74,999 (21.9%). Concerning occupation, 73% were full-time, followed by self-employed (9.3%), and part-time (9.1%). For ethnic background, 57.1% were white/European, followed by Asian (25.9%), and native American (6.0%).

Table 1: Discriminant Validity Heterotrait-Monotrait Ratio (HTMT)

Complete Data | Low LOHAS | High LOHAS | |||||||

CI | ATT | IT | CI | ATT | IT | CI | ATT | IT | |

CI | |||||||||

ATT | 0.40 | 0.20 | 0.38 | ||||||

IT | 0.56 | 0.71 | 0.32 | 0.74 | 0.73 | 0.50 | |||

To examine the differences between the low and high LOHAS group, a nonparametric Mann-Whitney test was conducted because it does not require the normal distribution of data. Overall, the results in table 2 indicate that the values of consumer innovativeness, attitude toward cryptocurrency, and the intention to adopt cryptocurrency were significantly higher in the high LOHAS group than those in the low LOHAS group. Hence, the overall pattern showed that the high LOHAS group is more innovative, has a more positive attitude toward cryptocurrency, and is more intended to use cryptocurrency.

Table 2: Results of the Mann-Whitney Test

Construct | Low LOHAS group | High LOHAS group | p | ||

M | SD | M | SD | ||

Consumer innovativeness | 2.74 | 0.95 | 4.19 | 0.76 | 0.00 |

Attitude | 3.29 | 1.06 | 3.92 | 0.94 | 0.00 |

Intention | 3.00 | 1.29 | 4.22 | 0.78 | 0.00 |

4.3. Structural Model Assessment (H1-H4)

The significance of the path coefficient was evaluated by bootstrapping method with a re-sampling of 1000 [46]. The complete model (n=452) results indicated that the effect of consumer innovativeness on the intention to adopt cryptocurrencies was positive (β = 0.303, t= 6.549, p <.001), supporting H1. Additionally, consumer innovativeness had positive influence on attitude toward cryptocurrency adoption (β = 0.374, t= 0.047, p <.001) and the attitude was also positively related to the intention to adopt cryptocurrency (β = 0.553, t= 11.907, p <.001), indicating the support of H2 and H3. Finally, an indirect effect of the consumer innovativeness on the crypto intention by way of the attitude was also established (β = 0.207, t= 6.230, p <.001), accepting H4.

To test the predictive ability of individual constructs in the model, the effect size was assessed [51]. The effect size of each exogenous construct was found to be statistically significant. Specifically, the effect of consumer innovativeness on cryptocurrency intention was medium (f2 =0.166), the effect of consumer innovativeness on attitude was medium ((f2 =0.162), and the effect of attitude on crypto intention was large (f2 =0.553) [52]. The results are summarized in table 3.

Table 3: Structural Model Evaluation

β | SE | t | P-Value | f2 | |

CI→INT | 0.30 | 0.05 | 6.55 | 0.000 | 0.17 |

CI→ATT | 0.37 | 0.05 | 7.87 | 0.000 | 0.16 |

ATT→INT | 0.55 | 0.05 | 11.91 | 0.000 | 0.55 |

CI→ ATT →INT | 0.21 | 0.03 | 6.23 | 0.000 | N/A |

4.4. Multi-Group Analysis (H5)

Two non-parametric approaches of the permutations test and Henseler’s multi-group analysis (MGA) were employed to find differences across the two groups of low versus high LOHAS[53]. The MGA results indicated that there is a significant difference in the path from consumer innovativeness to cryptocurrency intention. The positive effect of consumer innovativeness on cryptocurrency intention was significant and stronger in the high LOHAS group than in the low LOHAS group (|diff| = 0.324, p < .05), supporting H5(a). However, no significant difference in the path from consumer innovativeness to the attitude toward cryptocurrency was found (|diff| =0.148, p= .317), rejecting H5(b). Finally, the attitude toward cryptocurrency had a stronger positive effect on the intention to adopt cryptocurrency in the low LOHAS group than in the high LOHAS group ((|diff| =0.315, p < .05), indicating H5(c) reversely supported. Table 4 shows the MGA results.

Table 4: Multi-Group Analysis Results

Low LOHAS (N=117) | High LOHAS (N=106) | Low versus High | ||

Relationship | β | β | |diff| | p-value |

CI → INT | 0.17 | 0.49 | 0.32 | 0.03 |

CI → ATT | 0.19 | 0.34 | 0.15 | 0.32 |

ATT→ INT | 0.68 | 0.37 | 0.32 | 0.01 |

5. Discussion and Conclusion

The present study found psychological factors that influence consumer intention to adopt cryptocurrency. Our results showed that consumer innovativeness positively explained the intention to adopt cryptocurrency. This indicates that consumers with openness to new trials and a desire for early adoption of new items tend to have greater intention to use cryptocurrency. This is supported by other studies indicating consumer innovativeness as a significant driving factor for new technology acceptance (e.g., [11], [12]). Second, we found that consumer innovativeness is positively associated with attitude toward cryptocurrency. This shows that highly innovative consumers tend to positively evaluate cryptocurrency and favor trying them. It aligns with past literature suggesting that consumer innovativeness is a significant driver of a positive attitude toward the use of technology-based services [54]. Third, we revealed that attitude has a positive relationship with intention to cryptocurrency, and this demonstrates that the more one has a positive attitude toward cryptocurrency, the more one is likely to intend to use it. This confirmed the predictive ability of attitude on intention in the cryptocurrency context. Fourth, the mediating effect of attitude in the relationship between consumer innovativeness and cryptocurrency intention was proven. This implies that a part of the total effect of consumer innovativeness on intention to cryptocurrency is due to mediation by attitude [55].

Finally, we found the moderating role of the LOHAS lifestyle in the relationship between consumer innovativeness and intention to adopt cryptocurrency. Specifically, a positive moderating effect was revealed, meaning that the impact of consumer innovativeness on the cryptocurrency intention is enhanced when the consumer lives the LOHAS lifestyle. This adds empirical evidence to other research that indicated that LOHAS consumers are innovative early adopters who tend to learn, try, and adopt new technology more than any other segment [39], [56]. However, there was no significant moderating effect on the impact of consumer innovativeness on attitude. This indicates that the impact of consumer innovativeness on attitude toward cryptocurrency does not differ depending on the level of LOHAS. Finally, while the moderating effect of LOHAS in the relationship between attitude and cryptocurrency intention was found, the effect of attitude on intention was greater in the low LOHAS group than in the high LOHAS group. The weaker influence of attitude on the intention to use cryptocurrency in the high level of LOHAS consumers may suggest that there might be some potential factors that mitigate the effect of the positive attitude of consumers high in LOHAS on the intention to use cryptocurrency. This encourages future research to examine any demographic, psychographic, or contextual factors that influence the impact of the LOHAS lifestyle on the intention to cryptocurrency.

5.1 Theoretical Implications

The findings of this study provide theoretical implications. First, we developed a theoretical model to understand the determining psychological factors of consumers’ cryptocurrency adoption intention. Employing consumer innovativeness as a personality trait with another antecedent of attitude, this study founds how and why consumers intend to adopt cryptocurrency. Although academics have examined the cryptocurrency behavior within the TPB, few studies considered incorporating other individual difference factors in conjunction with TPB to better understand the empirical relationship between psychological motives and cryptocurrency behavior. This bears theoretical implications for future scholarly attempts to examine the ongoing adoption of cryptocurrency among consumers. Second, while the majority of the literature has focused on the determinants of cryptocurrency adoption from a technological perspective (e.g., innovative products, the complexity of products, ease of use), this study helps to better understand the underlying mechanism of consumers’ cryptocurrency adoption. Third, our findings provide significant empirical evidence of the LOHAS consumers’ innovative predisposition to technology. While previous researchers conceptually inferred that the LOHAS consumers adopt technology-based products earlier than other segments, this study empirically tested it and supported the previous discussion.

5.2 Managerial Implications

This study has several managerial implications. First, we found that the effect of consumer innovativeness on intention to adopt cryptocurrency is partially mediated by attitude. This provides businesses with insights into the need of appealing to the benefits of cryptocurrency (e.g., transaction transparency, fast transaction, security, and safety) as an alternative transaction/payment option to increase consumers’ favorable attitude [57]. Second, our findings on the likelihood of innovative consumers adopting cryptocurrency indicate that a new demographic profile may have access the cryptocurrency. Given that cryptocurrency users often represent newer and more cutting-edge customers of the company, businesses would need to put themselves in a position for cryptocurrency transactions with significant stakeholders [58]. Third, as consumers high in the LOHAS lifestyle are more likely to intend to adopt cryptocurrency, businesses in health, well-being, or sustainability sectors may consider incorporating cryptocurrency into their business models as a payment, transaction, reward, or compensation method. Utilizing cryptocurrencies in day-to-day businesses may encourage the development of new and creative trade of healthy and sustainable goods and services, extending the market reach of the businesses [59].

5.3 Limitations and Future Directions

The study has several limitations and suggestions for future research. First, this study only includes attitude as a mediating factor between consumer innovativeness and cryptocurrency intention. Even though the inclusion of attitude increases the empirical relationship between personality traits and behavior in a specific context [28], future research may consider incorporating other psychological and/or external factors such as perceived behavioral control and/or subjective norms that predict behavioral intention in a more systematic manner. Second, the present study found that the impact of attitude on intention is less in the high LOHAS group than in the low LOHAS group. The result encourages future research to identify potential influential factors that generate the attitude-intention gap, particularly in high LOHAS consumers. For example, LOHAS consumers’ environmental consciousness might discourage them from actually using cryptocurrency for its negative environmental impact regardless of their positive evaluation of other aspects of cryptocurrency (e.g.,[60], [61]). Finally, while this study measures consumer innovativeness based on a one-dimensional construct, future studies could use various subdimensions of consumer innovativeness as predictors of cryptocurrency intention to provide a more in-depth understanding of the role of consumer innovativeness on the intention to adopt cryptocurrency.

A. Tavasoli, “Investigating, Choosing and Prioritizing the Challenges of Using Crypto currencies in Global Transactions,” Agricultural Marketing and Commercialization Journal, vol. 4, no. 1, pp. 13–24, 2020.

Davidson, “The Digital Coin Revolution – Crypto Currency – How to Make Money Online – Google Books.” https://www.google.com/books/edition/The_Digital_Coin_Revolution_Crypto_Curre/yn4pAwAAQBAJ?hl=en&gbpv=1&dq=Davidson+and+Naveed,+2013&pg=PT5&printsec=frontcover . (accessed: 04-Jul-2022).

H. T. M. Gamage, · H D Weerasinghe, · N G J Dias, “A Survey on Blockchain Technology Concepts, Applications, and Issues,” SN Computer Science, vol. 1, pp. 114, 2020, doi:10.1007/s42979-020-00123-0.

S. Sukumaran, T. S. Bee, S. Wasiuzzaman, “Cryptocurrency as an Investment: The Malaysian Context,” Risks, vol. 10, no. 4, 2022, doi:10.3390/risks10040086.

Supply Chain Game Changer, “Why is Cryptocurrency Rising in Popularity?” https://supplychaingamechanger.com/why-is-cryptocurrency-rising-in-popularity/ . (accessed: 04-Jul-2022).

Insider Intelligence, “34 Million US adults own cryptocurrency.” https://www.insiderintelligence.com/insights/us-adults-cryptocurrency-ownership-stats . (accessed: 04-Jul-2022).

S. Choi, R. A. Feinberg, “The lohas (Lifestyle of health and sustainability) scale development and validation,” Sustainability (Switzerland), vol. 13, no. 4, pp. 1–17, 2021, doi:10.3390/su13041598.

K. Bilharz, M., & Schmitt, “Going Big with Big Matters: The Key Points Approach to Sustainable Consumption,” GAIA-Ecological Perspectives for Science and Society, pp. 232–235, 2011.

K. Pícha, J. Navrátil, “The factors of Lifestyle of Health and Sustainability influencing pro-environmental buying behaviour,” Journal of Cleaner Production, vol. 234, pp. 233–241, 2019, doi:10.1016/j.jclepro.2019.06.072.

T. Ning, “LOHAS Retail & Tech Trends.” http://www.thelohasgroup.com/news/2013/11/5/lohas-retail-tech-trends . (accessed: 04-Jul-2022).

O. S., “LOHAS Market Research.” https://askwonder.com/research/lohas-market-research-brgpmi96r .

A. Sousa et al., “Cryptocurrency adoption: a systematic literature review and bibliometric analysis,” , doi:10.1108/EMJB-01-2022-0003.

J. Cruz-Cárdenas et al., “Drivers of technology readiness and motivations for consumption in explaining the tendency of consumers to use technology-based services,” 2020, doi:10.1016/j.jbusres.2020.08.054.

J. Cotte, S. L. Wood, “Families and innovative consumer behavior: A triadic analysis of sibling and parental influence,” Journal of Consumer Research, vol. 31, no. 1, pp. 78–86, 2004, doi:10.1086/383425/0.

G. Roehrich, “Consumer innovativeness Concepts and measurements,” , doi:10.1016/S0148-2963(02)00311-9.

J.-B. E. M. Steenkamp, M. Wedel, “A Cross-National Investigation into the Individual and National Cultural Antecedents of Consumer Innovativeness,” Journal of Marketing, vol. 63, no. 2, pp. 55–69, 1999.

J. Bartels, M. J. Reinders, “Consumer innovativeness and its correlates: A propositional inventory for future research Keywords: Consumer innovativeness Propositional inventory Systematic literature review Innate innovativeness Domain-specific innovativeness Innovative behavior,” 2010, doi:10.1016/j.jbusres.2010.05.002.

A. Strebinger et al., “Profiling early adopters of blockchain-based hotel booking applications: demographic, psychographic, and service-related factors,” vol. 24, pp. 1–30, 2022, doi:10.1007/s40558-021-00219-0.

A. Nazifi et al., “A Bit(coin) of happiness after a failure: An empirical examination of the effectiveness of cryptocurrencies as an innovative recovery tool,” Journal of Business Research, vol. 124, pp. 494–505, 2021, doi:10.1016/j.jbusres.2020.11.012.

D. Kbilashvili, “Influence of E-Commerce and Cryptocurrency on Purchasing Behavior of Wine Customers,” Type: Double Blind Peer Reviewed International Research Journal Publisher: Global Journals Online, vol. 18, no. 3, pp. 0–4, 2018.

Icek Ajzen, “From Intentions to Actions: A Theory of Planned Behavior,” in Action Control, ed J. Kuhl, J., Beckmann (Springer, Berlin, Heidelberg, 1985), 11–39, doi:10.1007/978-3-642-69746-3_2.

D. F. Midgley, G. R. Dowling, “Innovativeness: The Concept and Its Measurement,” Journal of Consumer Research, vol. 4, no. 4, pp. 229, 1978, doi:10.1086/208701.

J. Jansson, W. O. Library, “Consumer Eco-Innovation Adoption: Assessing Attitudinal Factors and Perceived Product Characteristics,” Business Strategy and the Environment, vol. 20, pp. 192–210, 2011, doi:10.1002/bse.690.

E. C. Hirschman, “Innovativeness, Novelty Seeking, and Consumer Creativity,” Journal of Consumer Research, vol. 7, no. 3, pp. 283, 1980, doi:10.1086/208816.

J. A. Mehrabian, A., & Russell, An approach to environmental psychology (The MIT Press, 1974).

P. A. Dabholkar, R. P. Bagozzi, “An Attitudinal Model of Technology-Based Self-Service: Moderating Effects of Consumer Traits and Situational Factors,” Journal of the Academy of Marketing Science, vol. 30, no. 3, pp. 184–201, 2002.

R. Thakur, A. Angriawan, J. H. Summey, “Technological opinion leadership: The role of personal innovativeness, gadget love, and technological innovativeness,” Journal of Business Research Technological, vol. 69, pp. 2764–2773, 2016, doi:10.1016/j.jbusres.2015.11.012.

I. Ajzen, “The theory of planned behavior,” Organizational Behavior and Human Decision Process, vol. 50, pp. 179–211, 1991, doi:10.1080/10410236.2018.1493416.

I. Fishbein, M., & Ajzen, Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research (Reading, MA: Addison-Wesley, 1975).

M. K. Anser et al., “Social media usage and individuals’ intentions toward adopting Bitcoin: The role of the theory of planned behavior and perceived risk,” International Journal of Communication Systems, vol. 33, no. 17, pp. e4590, 2020, doi:10.1002/DAC.4590.

H. Albayati, S. K. Kim, J. J. Rho, “Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach,” Technology in Society, vol. 62, pp. 101320, 2020, doi:10.1016/j.techsoc.2020.101320.

C. Yoon, “Theory of Planned Behavior and Ethics Theory in Digital Piracy: An Integrated Model,” Journal of business ethics, vol. 100, no. 3, pp. 405–417, 2011, doi:10.1007/s10551-010-0687-7.

S. A. Al-Jundi, A. Shuhaiber, R. Augustine, “The mediating effect of leader–member exchange in relationship with emotional intelligence, job satisfaction, and turnover intention,” Cogent Business & Management, vol. 6, no. 1, pp. 1698849, 2019, doi:10.1080/23311975.2019.1698849.

J. Hwang, J. J. Kim, K.-W. Lee, “Investigating consumer innovativeness in the context of drone food delivery services: Its impact on attitude and behavioral intentions,” Technological Forecasting & Social Change, vol. 163, 2021, doi:10.1016/j.techfore.2020.120433.

X. He, W. Zhan, “How to activate moral norm to adopt electric vehicles in China? An empirical study based on extended norm activation theory,” Journal of Cleaner Production, vol. 172, pp. 3546–3556, 2018, doi:10.1016/j.jclepro.2017.05.088.

J.-C. Hong, P.-H. Lin, P.-C. Hsieh, “The effect of consumer innovativeness on perceived value and continuance intention to use smartwatch,” Computers in Human Behavior, vol. 67, pp. 264e272, 2017, doi:10.1016/j.chb.2016.11.001.

Mİray Baybars and Ketİ Ventura, Understanding new consumers through the lense of a promising market segement: LOHAS, vol. 59, (Newcastle: Cambridge Scholars Publishing, 2020).

Natural Marketing Institute (NMI), “20th Edition Consumer Report, 2020 Health & Wellness Trends in America.” https://www.nmisolutions.com/research-reports/health-wellness-reports/20th-edition-consumer-report-2020-health-wellness-trends-in-america/ . (accessed: 05-Jul-2022).

Howard, “LOHAS consumers are taking the world by storm,” Total Health, vol. 29, no. 3, pp. 58, 2007.

S. Heidenreich, M. Handrich, “Adoption of technology-based services: the role of customers’ willingness to co-create,” Journal of Service Management, vol. 26, no. 1, pp. 44–71, 2015, doi:10.1108/JOSM-03-2014-0079.

R. M. Stock, P. Oliveira, E. Von Hippe, “Impacts of Hedonic and Utilitarian User Motives on the Innovativeness of User-Developed Solutions,” Journal of Product Innovation Management, vol. 32, no. 3, pp. 389–403, 2015, doi:10.1111/JPIM.12201.

J. B. E. M. Steenkamp, K. Gielens, “Consumer and Market Drivers of the Trial Probability of New Consumer Packaged Goods,” Journal of Consumer Research, vol. 30, no. 3, pp. 368–384, 2003, doi:10.1086/378615.

B. A. S. Martin et al., “Dark personalities and Bitcoin®: The influence of the Dark Tetrad on cryptocurrency attitude and buying intention,” Personality and Individual Differences, vol. 188, pp. 111453, 2022, doi:10.1016/j.paid.2021.111453.

S. Abramova, R. Böhme, “Perceived Benefit and Risk as Multidimensional Determinants of Bitcoin Use: A Quantitative Exploratory Study,” International Conference on Information Systems, 2016.

F. Kressmann et al., “Direct and indirect effects of self-image congruence on brand loyalty,” Journal of Business Research, vol. 59, pp. 955–964, 2006, doi:10.1016/j.jbusres.2006.06.001.

J. F. Hair et al., “An assessment of the use of partial least squares structural equation modeling in marketing research,” Journal of Academy of Marketing Science, vol. 40, pp. 414–433, 2012, doi:10.1007/s11747-011-0261-6.

R. R. Henseler, J., Ringle, C. M., & Sinkovics, “The use of partial least squares path modeling in international marketing,” Advances in International Marketing, vol. 20, pp. 277–319, 2009, doi:10.1108/S1474-7979(2009)0000020014.

J. F. Hair et al., “When to use and how to report the results of PLS-SEM,” European Business Review, vol. 31, no. 1, pp. 2–24, 2019, doi:10.1108/EBR-11-2018-0203.

J. Hair et al., “An updated and expanded assessment of PLS-SEM in information systems research,” Industrial Management & Data Systems, vol. 117, no. 3, pp. 442–458, 2017, doi:10.1108/IMDS-04-2016-0130.

J. Henseler, M. Sarstedt, “Goodness-of-fit indices for partial least squares path modeling,” Comput Stat, vol. 28, pp. 565–580, 2013, doi:10.1007/s00180-012-0317-1.

J. F. Hair, M. C. Howard, C. Nitzl, “Assessing measurement model quality in PLS-SEM using confirmatory composite analysis,” Journal of Business Research, vol. 109, pp. 101–110, 2020, doi:10.1016/J.JBUSRES.2019.11.069.

J. Cohen, Statistical Power Analysis for the Behavioral Sciences (New York: Routledge, 1988).

J. Henseler, G. Hubona, P. A. Ray, “Using PLS path modeling in new technology research: updated guidelines,” Industrial management & data systems, vol. 116, no. 1, pp. 2–20, 2016, doi:10.1108/IMDS-09-2015-0382.

J. Cruz-Cárdenas et al., “Role of demographic factors, attitudes toward technology, and cultural values in the prediction of technology-based consumer behaviors: A study in developing and emerging countries,” Technological Forecasting & Social Change, vol. 149, pp. 119768, 2019, doi:10.1016/j.techfore.2019.119768.

J. M. James, L. R., & Brett, “Mediators, moderators, and tests for mediation,” Journal of Applied Psychology, vol. 69, no. 2, pp. 1–48, 1984.

Natural Marketing Institute (NMI), “Understanding the TM LOHAS Market Report.” 2008.

Deloitte, “The rise of using cryptocurrency in business.” https://www2.deloitte.com/us/en/pages/audit/articles/corporates-using-crypto.html . (accessed: 04-Jul-2022).

Deloitte, “Corporates using crypto_Conducting business with digital assets,” pp. 1–17, 2019.

Deloitte, “Can Crypto Add Value to Business Operations?” https://deloitte.wsj.com/articles/can-crypto-add-value-to-business-operations-01624388526 . (accessed: 05-Jul-2022).

A. Ergüven, M., & Yilmaz, “The first glocal lifestyle “LOHAS “: a study in Thrace,” The Journal of Academic Social Science Studies, vol. 51, pp. 265–275, 2016, doi:10.9761/JASSS3715.

S. Erdogan et al., “Analyzing asymmetric effects of cryptocurrency demand on environmental sustainability,” Environmental Science and Pollution Research, vol. 29, no. 21, pp. 31723–31733, 2022, doi:10.1007/s11356-021-17998-y.

- Sooyeon Choi, Richard A. Feinberg, “Education and Sustainability Habits – Portuguese Students’ Perspectives”, Journal of Engineering Research and Sciences, vol. 4, no. 7, pp. 15–25, 2025. doi: 10.55708/js0407002